A Certificate of Good Standing is a document that confirms a business entity’s legal existence and compliance with state regulations. It is a crucial document that businesses often need to provide to banks, investors, and other stakeholders. A Certificate of Good Standing is not just a piece of paper; it holds significant value for businesses and their stakeholders.

For corporations, LLCs, and partnerships, a Certificate of Good Standing is an essential document that verifies their legal status and compliance with state regulations. It shows that the business entity is up-to-date with all its filings, taxes, and fees. Banks and investors often require a Certificate of Good Standing before providing loans or funding to a business. It can also help businesses win contracts and establish credibility with clients.

A Certificate of Good Standing is not just a document that businesses need to provide to banks and investors. It is a valuable asset that can help businesses build trust and credibility with their stakeholders. By maintaining compliance with state regulations and obtaining a Certificate of Good Standing, businesses can demonstrate their commitment to ethical and legal business practices.

The Importance of a Certificate of Good Standing

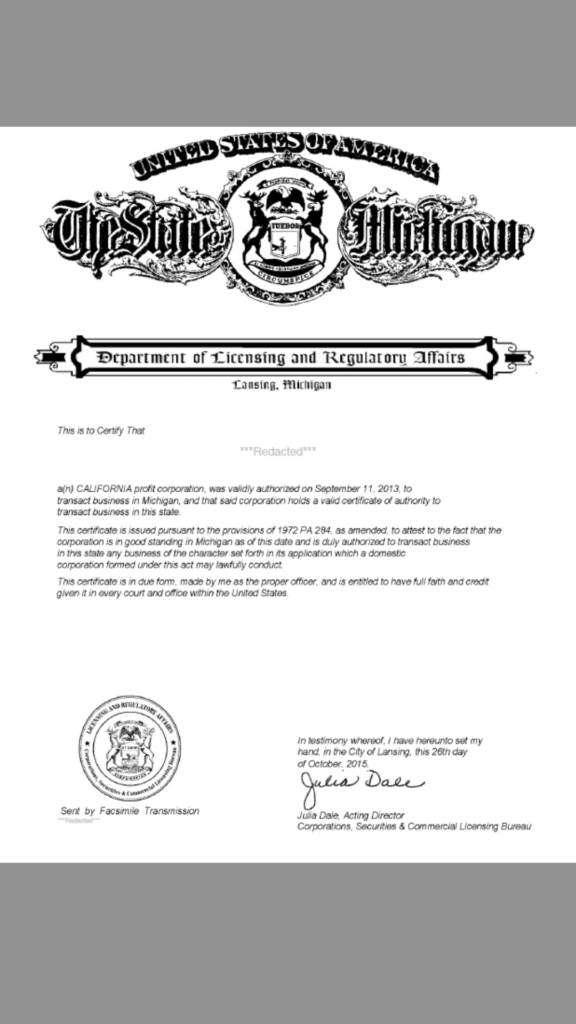

A Certificate of Good Standing is a document issued by the Secretary of State that confirms a business is authorized to do business in a particular state and has complied with all necessary legal requirements. This document is an essential part of a company’s legal compliance and is often required for a variety of business transactions.

Legal Recognition and Compliance

A Certificate of Good Standing is a legal document that provides evidence that a business is in good standing with the state in which it is registered. It confirms that the company has met all legal requirements, including filing the necessary paperwork, paying all fees, and maintaining compliance with state regulations. This document is often required by banks, investors, and other businesses before entering into any transactions with the company.

Facilitating Business Operations

A Certificate of Good Standing is also essential for facilitating business operations. It is often required when applying for a business license or permit, renewing a business license, or filing an annual report. Without this document, a business may not be able to operate legally in a particular state, which can hinder its ability to conduct business and generate revenue.

Enhancing Business Reputation

A Certificate of Good Standing can also enhance a company’s reputation. It shows that the business is in good standing with the state and has complied with all legal requirements. This can help build trust and credibility with customers, investors, and other businesses, which can lead to increased opportunities and revenue.

In conclusion, a Certificate of Good Standing is an essential document for any business operating in the United States. It provides legal recognition and compliance, facilitates business operations, and enhances a company’s reputation. Businesses should ensure they maintain good standing with the state in which they are registered and obtain a Certificate of Good Standing as needed to conduct business transactions.

Obtaining a Certificate of Good Standing

A Certificate of Good Standing is an important document that verifies that a company or business is authorized to conduct business in a particular state. It is also known as a Certificate of Existence or Certificate of Authorization. In order to obtain one, certain procedures must be followed.

Application Process and Requirements

The application process for obtaining a Certificate of Good Standing varies from state to state. Generally, the process involves submitting an application to the state agency responsible for business registration. The application will require certain information, such as the name and address of the business, the names of its officers and directors, and the business’s tax identification number.

In addition to the application, certain requirements must be met. For example, the business must be registered with the state and must be current on all taxes and fees owed to the state. The business may also be required to provide a current financial statement or other documentation.

State-Specific Procedures

Each state has its own specific procedures for obtaining a Certificate of Good Standing. Some states require that the application be submitted online, while others require a paper application. Some states may also require that the application be notarized or that certain fees be paid.

It is important to research the specific procedures for the state in which the business is registered in order to ensure that all requirements are met and the application is submitted correctly.

Associated Costs and Fees

The fees associated with obtaining a Certificate of Good Standing vary by state. In general, there is a filing fee that must be paid in order to submit the application. Some states may also charge additional fees for expedited processing or for certified copies of the document.

It is important to research the fees associated with obtaining a Certificate of Good Standing in the state in which the business is registered in order to ensure that the correct amount is paid and the application is not delayed.

In conclusion, obtaining a Certificate of Good Standing is an important step for any business that wants to conduct business in a particular state. By following the correct procedures and meeting all requirements, a business can obtain this important document and ensure that it is authorized to conduct business in the state.

Utilizing the Certificate in Business Activities

A Certificate of Good Standing is a vital document that holds significant value in the business world. It serves as proof that a company is registered with the state and has complied with all the necessary legal requirements. This section will explore how businesses can use a Certificate of Good Standing in various business activities.

Transactions and Financial Operations

A Certificate of Good Standing is often required to open a bank account, obtain a loan, or engage in financial transactions. Financial institutions and lenders use this document to evaluate a company’s creditworthiness and assess the risk involved in lending money. Having a Certificate of Good Standing can help businesses secure funding and establish a good reputation with financial institutions.

Contracts and Legal Agreements

When entering into contracts or legal agreements, a Certificate of Good Standing is often required to demonstrate that a company is qualified to do business. This document can help businesses avoid legal disputes and ensure that they are compliant with state regulations. It can also help establish credibility and trust with business partners and investors.

Expanding or Restructuring Your Business

If a business is looking to expand or restructure, a Certificate of Good Standing may be required to register in a new state, obtain a business license, or apply for government contracts. This document can help businesses navigate the legal requirements of operating in a new state and ensure that they are compliant with all necessary regulations.

In conclusion, a Certificate of Good Standing is a valuable document that can help businesses in various business activities. It can be used to establish credibility and trust with business partners, investors, and financial institutions. It can also help businesses avoid legal disputes and ensure that they are compliant with state regulations. Therefore, it is essential for businesses to obtain and maintain a Certificate of Good Standing to operate successfully.

Maintaining Good Standing Status

To maintain a certificate of good standing, a company must comply with a number of requirements and regulations. Failure to do so can result in the revocation of the certificate and the loss of good standing status. Here are some key considerations to keep in mind:

Get a Certificate of Good Standing Today

Regular Compliance and Reporting

One of the most important aspects of maintaining good standing status is complying with all relevant laws and regulations. This includes filing annual reports, renewing business licenses, and ensuring that all necessary fees are paid on time. Companies should also be aware of any changes to the law that may affect their operations, and take steps to comply with these changes as soon as possible.

Renewal and Expiration Considerations

Another important consideration is the expiration date of the certificate of good standing. Companies should be aware of when their certificate is set to expire, and take steps to renew it well in advance. Failure to do so can result in the loss of good standing status, which can have serious consequences for the company’s operations.

To avoid these issues, companies should develop a system for tracking important dates and deadlines, and ensure that all necessary paperwork is filed on time. This can include creating a calendar of important dates, setting reminders in a digital calendar, or using a specialized compliance management software.

Overall, maintaining good standing status requires a commitment to regular compliance and reporting, as well as careful attention to renewal and expiration considerations. By staying on top of these requirements, companies can ensure that they remain in good standing and continue to operate smoothly and efficiently.

Frequently Asked Questions

What are the requirements to obtain a Certificate of Good Standing for an LLC?

To obtain a Certificate of Good Standing for an LLC, the business must be registered with the state and must be current on all of its state tax obligations. Additionally, the LLC must be in compliance with all state regulations and must have filed all required reports and documents.

Why is a Certificate of Good Standing important for businesses?

A Certificate of Good Standing is important for businesses because it serves as proof that the business is authorized to do business in the state and that it is in compliance with all state regulations. It is often required when a business seeks to obtain financing, enter into contracts, or engage in other business activities.

What information is typically included in a Certificate of Good Standing?

A Certificate of Good Standing typically includes the name and address of the business, the date of incorporation or registration, and a statement indicating that the business is in good standing with the state. It may also include information on any outstanding tax liabilities or other legal issues.

How can a doctor acquire a Good Standing Certificate?

A doctor can acquire a Good Standing Certificate by contacting the licensing board or agency that oversees their practice and requesting the certificate. The requirements for obtaining a Good Standing Certificate may vary depending on the state and the type of medical license held.

In what situations is a Certificate of Good Standing necessary?

A Certificate of Good Standing is necessary in a variety of situations, including when a business seeks to obtain financing, enter into contracts, or engage in other business activities. It may also be required when a business applies for certain licenses or permits, or when it seeks to participate in government contracts or programs.

How does one verify the authenticity of a Certificate of Good Standing?

To verify the authenticity of a Certificate of Good Standing, one should contact the state agency or office that issued the certificate and request confirmation. In some cases, it may be possible to verify the authenticity of the certificate online.